|

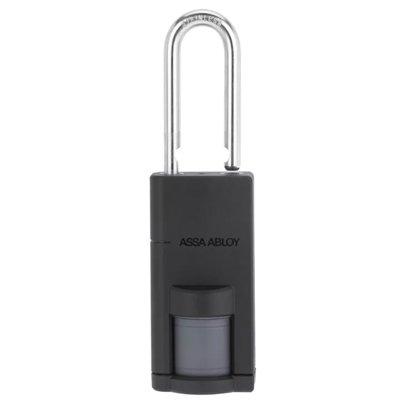

| Success in the access control arena is enhanced if the business has a global presence |

Vanderbilt 2014/2015 Review and Forecast:

In 2014, our industry continued to be quite dynamic. While there are several “conglomerates” in the industry, such as UTC and Honeywell, who have been consolidators, there are also other companies (like ours) that are focused solely on security. The industry moves in both directions—some companies consolidating and acquiring, while others are more focused and concentrated. This includes some which are spinning off parts of their business into new entities altogether, such as Allegion from Ingersoll Rand or Siemens divesting their Security Products business to Vanderbilt.

For access control system manufacturers (OEMs), the competitive landscape is still quite fragmented. This engenders a very competitive marketplace, but is not always helpful to end users, integrators and security consultants. While many of the small OEMs have changed very little over 10 or 20 years, there are also newer entrants that have impacted the industry, such as Open Options and Brivo. We believe that with the wide variety of smaller OEMs that still exist, there is continued opportunity for consolidation at this level of the value chain.

Going forward, success in the access control arena is enhanced if the business has a global presence—major enterprise customers want to standardize on one integrated solution and a vendor that has an extensive network of integrator and technology partners. An experienced and loyal reseller channel is especially important to ensuring that there is less execution risk and that end user customers end up with systems that operate reliably and provide the desired solution.

Larger, consolidated manufacturers can afford higher levels of R&D investment. In an industry sector that is sometimes slow to evolve and utilize the latest tools coming out of the IT market, this will be a key point of differentiation and added value as ongoing product enhancements are released at a continual pace.

Looking to 2015, we can expect to see a lot of continued M&A activity, especially with a lot of “cheap” money in the hands of investors who realize the security industry will continue to experience steady growth and the need for continual investments and enhancements in the technology incorporated into the products most in demand.

See the full coverage of 2014/2015 Review and Forecast articles here