Interface Security Systems, a managed service provider delivering business security, managed network, UCaaS, and business intelligence solutions to distributed enterprises, announced the completion of a $60 million equity financing transaction led by its current sponsors SunTx Capital Partners and Prudential Capital Partners.

The additional equity capital will help facilitate the company’s growth strategy and strengthen its capabilities, featuring highly differentiated managed services.

Overall customer experience

This new capital comes in the wake of a highly productive 2020 where Interface has:

- Made significant investments in innovation, product development, and new technology infrastructure

- Scaled operations and expanded service offering to a broader range of verticals

- Launched new services and strategic partnerships

- Achieved a 250% YoY growth in new customer acquisitions

- Further enhanced the overall customer experience

Increasing security threats

This new capital will catalyze the growth phase that Interface is already in"

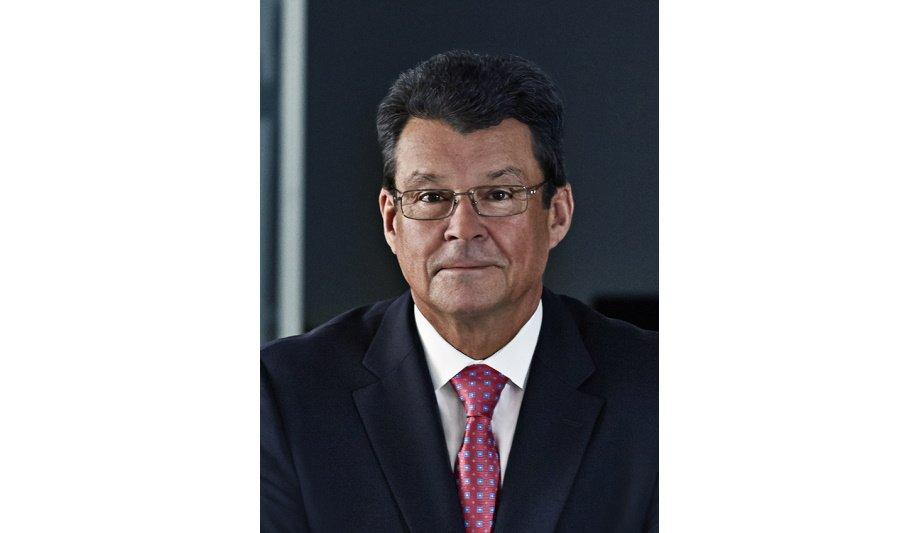

Michael Shaw, CEO of Interface Security Systems, said, “We see a major digital transformation taking place within numerous distributed enterprise business models seeking to adapt to changing consumer behavior and increasing security threats. Interface is a leading provider of innovative business security solutions, remote managed video monitoring, and networking infrastructure that provides distributed enterprises with next-generation store technology and 24/7 system management to keep pace with these trends. This capital infusion will enable us to continue to stay ahead of the technology curve and further solidify our position as a key technology partner for consumer-facing businesses.”

Ned Fleming, Founding Partner of SunTx Capital Partners, said, “This new capital will catalyze the growth phase that Interface is already in. We believe the company is strongly positioned to help businesses integrate the management of their security, managed networks, and business intelligence, particularly as we emerge from the global health crisis.”

Supply chain management

Robert Derrick, Managing Director and Partner with Prudential Capital Partners, said, “Interface is well-positioned to support consumer-facing distributed enterprises as they transform their business models. We are happy to be a part of this new round of investment to help fuel their evolution and growth.”

“As the economy emerges from the pandemic, we will see many new business models develop to support remote working, curbside delivery and smarter supply chain management that will require innovative networking, enhanced security, and business analytics solutions,” comments John Mack of Imperial Capital, an advisor to Interface. “This growth capital positions Interface to take advantage of opportunities in areas where they have a demonstrated track record of success.”