There’s a new big player – and familiar household name – coming into the security marketplace with the announcement of Motorola’s intent to acquire Canadian video manufacturer Avigilon Corporation, provider of video surveillance and analytics. Motorola Solutions points to an “avalanche of video in public and private sectors” as a motivation for the acquisition.

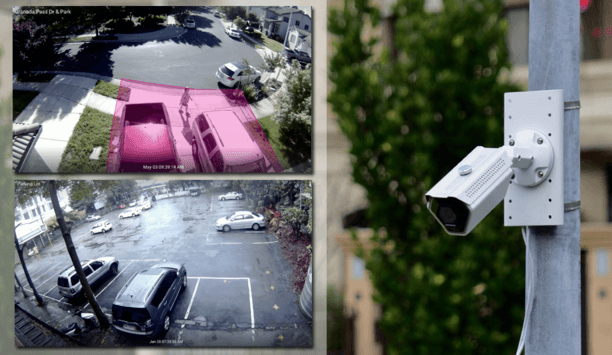

Motorola Solutions’ dominance in the public safety market – where the Chicago company supplies police technologies, radios and other products – will provide new opportunities for Avigilon in a realm where it previously has not been dominant. Avigilon has millions of cameras deployed across airports, rail, streets, and public and private buildings.

Meanwhile, Avigilon will “bring [its] advanced video surveillance and analytics platform to [Motorola’s] rapidly evolving public safety workflow,” according to Motorola, and enhance the larger company’s portfolio of “mission-critical communications technologies.” Avigilon’s end-to-end security and video surveillance platform includes cameras, analytics, video management and video storage.

Avigilon has millions of cameras deployed across airports, rail, streets, and public and private buildings

The Broader Solution

Early clues point to Motorola positioning Avigilon as part of a broader solution, especially in the municipal/safe cities market. The company says the acquisition will enable more safe cities projects and more public-private partnerships between local communities and law enforcement. Motorola sees Avigilon as “a natural extension to global public safety and U.S. federal and military” applications, according to the company.

The all-cash deal pays CAD$27.00 per share of Avigilon, and totals approximately $1 billion including Avigilon’s net debt. Not a bad price considering Avigilon’s stock price has traded as low as $13 a share in the last year. Avigilon has 1,200 employees with locations in Vancouver and Richmond, British Columbia, and Dallas and Plano, Texas. Revenue was $354 million in 2016. The transaction is expected to be completed in Q2 of 2018.

Deploying Pre-engineered Solutions

As an innovator in the security market, Avigilon has spearheaded an end-to-end solutions approach. Their success has even prompted some component manufacturers to expand their proposition into a broader “solutions” sale. Led largely by Avigilon, the industry pendulum has swung toward the simplicity of deploying pre-engineered end-to-end solutions. Open systems integrated using best-in-breed components from several manufacturers still have their devotees, and are needed in some situations, but Avigilon has made a strong case for the end-to-end alternative. Others have followed.

|

| The all-cash deal pays CAD$27.00 per share of Avigilon, and totals approximately $1 billion including Avigilon’s net debt |

Avigilon has also lately been a leader in implementing artificial intelligence and deep learning, including Appearance Search technology that can locate a vehicle or person from video across a site. Avigilon’s video surveillance platform seeks to transform video from reactive – looking back at what has taken place – to proactive, issuing alerts in real time. Avigilon also recently introduced Avigilon Blue cloud service platform to enable video system users to manage more sites with fewer resources.

Investing And Building

Motorola would presumably continue Avigilon’s licensing program, but rules-based video analytics patents’ importance may fade

Motorola is not a completely new name to the security market. Old-timers will remember Motorola Indala, a previous presence in the RFID access control market that was sold to HID Corp. in 2001. More recently, Motorola Solutions has invested in Vidsys, a provider of converged security and information management (CSIM) software and has implemented Vidsys CSIM through its Protect Series unified platform that aggregates and analyses information from multiple inputs for military and federal government properties. Motorola is also known as the inventor of the Six Sigma quality improvement process - and commitment to quality plays well among security integrators and end users.

Avigilon owns 750 U.S. and international patents, including some covering basic underlying principles of video analytics, for which several video companies currently pay license fees. Motorola would presumably continue the licensing program, although the importance of rules-based video analytics patents may fade as new deep learning and artificial intelligence (AI) approaches to video analytics emerge.

Channel Conflict

A possible concern surrounding the acquisition is the issue of channel conflict. When it comes to larger end user customers, Motorola has embraced a direct-to-user approach that could be problematic in the eyes of Avigilon’s 2,000 resellers. Among the benefits Motorola says they bring to the table is the ability to “leverage [their] direct enterprise safes force for large deals.” They also say they “complement Avigilon’s channel with [Motorola’s] channel network.”

The security industry has a spotty history of larger companies entering the market to buy existing businesses. Some have been a good fit, while others have not. The entrepreneurial spirit of more than one successful security company has suffered under larger corporate ownership, sometimes withering as new corporate overlords cut costs and stifle R&D. The more successful recent large acquisitions in our market – notably Canon’s acquisition of Milestone Systems and Axis Communications – have worked well because the acquired companies have retained some degree of independence and preserved the existing corporate culture.

In the case of Motorola and Avigilon, obviously, time will tell.

Learn why leading casinos are upgrading to smarter, faster, and more compliant systems