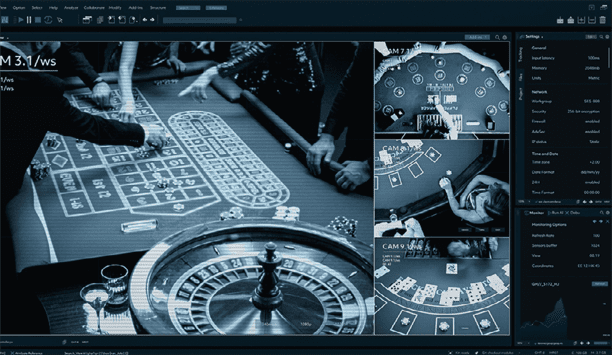

Check Out Our Special Report On Casino Security

Has Price Erosion Ended (Or Slowed Down) In Security?

- Chinese firms cause 'race to the bottom' in security pricing erosion.

- Cybersecurity concerns increase costs, creating challenges for Chinese security companies.

- Additional edge device functionality impacts the pricing in the security market.

Editor Introduction

One impact of Chinese companies entering the physical security market has been an erosion in product pricing, creating what has been called the "race to the bottom." However, political forces and cybersecurity concerns have presented new challenges for Chinese companies. Adding cybersecurity increases costs, and the addition of more functionality to edge devices is another trend that has impacted product pricing. We asked this week's Expert Panel Roundtable: Has price erosion ended (or slowed down) in the security market?

Price erosion or commoditization in the security market has shifted to other aspects of the business instead of slowing down. Price wars were fought at the low end of the market where manufacturers typically cut corners (lower specs and limited cybersecurity measures). However, $50 per camera on a high-volume sale makes it hard to further reduce costs. Now low-end, price-driven video manufacturers introduce 4K resolution cameras at extremely low prices. Recently we have also witnessed a lowering of the cost of VMS software licenses with some manufacturers who sell both cameras and software, giving away free VMS licenses with the cameras in an effort to lock the customer into their brand of camera. In my mind, the industry should educate the customer of the true value of the features and benefits of the products being developed.

In Europe, we began to see the “race to the bottom” come to an end last year. The main driving force was concerns over surveillance cybersecurity, meaning manufacturers competing less often on price. We’ve seen many low-cost players retreat to re-engineer and eliminate vulnerabilities and “back doors.” That cost is reflected in pricing, plus cyber and quality concerns make it easier to sell against lower-priced, inferior products. The U.S. ban and widespread criticism of Chinese tech continue to have a significant impact with vendors eliminated from projects simply due to country of origin. These same companies are investing heavily in lobbyists and marketing to fight back, while simultaneously incurring the costs of overseas expansion. This has led to fewer price cuts in Europe where Chinese players are keen to offset poor U.S. sales. Users are now more likely to consider lifecycle costs, and which means looking beyond initial price points.

Certainly, the price of access control readers and credentials have seen an apparent price erosion over the last couple of decades. It’s inevitable that as volumes of products go up, the costs go down – that’s simple economics. When you consider the huge scale of production in China and other parts of Southeast Asia, it’s not hard to see why. These high-volume producers have lowered their cost base to account for the reductions in selling price. This approach has always been common; there are always producers that will choose to join a market and disrupt it! The change now, though, is that many security providers are choosing to sell services and support to accompany products, and this is where the profits are to be found. The way end users spend on their security is changing, and this has helped to mitigate many of the potential issues from price erosion.

Price erosion in the security market, in general, appears to be slowing down. The political pressure on Chinese products has tamped down demand for these products in favor of other manufacturers. However, uncertainty breeds opportunity, so it would not be surprising to see another low price/low margin manufacturer appear to fill any Chinese void. An existing manufacturer could also step up, looking for a “land grab” opportunity before the Chinese situation settles out. In any case, I would expect to see prices begin to creep up over the next 9 to 12 months, particularly on commoditized products. One school of thought also says that we have reached the bottom everyone has been racing towards, and prices just cannot go any lower without a quantum leap advancement in technology. Moore’s Law is alive and well and chip technology continues to advance, so that quantum leap could be closer than we think.

Editor Summary

Lower-priced security products can be tempting. However, a need for better quality and more functionality, not to mention a greater emphasis on the total cost of ownership, can offset the temptation to buy based solely on price in many applications. Manufacturers are continuing to seek new ways to add value to their products, and to justify a decent pricing level that will ensure they continue to thrive financially. Value trumps cost, and adding value is the best antidote to price erosion.

- Related companies

- TDSi

- 3xLOGIC, Inc.

- Hanwha Vision America

- IDIS

- Related links

- Hanwha Vision Video Surveillance software

- IDIS Video Surveillance software

- TDSi Video Surveillance software

- Hanwha Vision IP cameras

- Hanwha Vision Access control readers

- IDIS IP cameras

- TDSi IP cameras

- TDSi Access control readers

- Biometric Access control readers

- Network IP cameras

- Standalone / Networkable Access control readers

- Management Software Video Surveillance software

- Related categories

- Video Surveillance software

- IP cameras

- Access control readers

- View all news from

- TDSi

- 3xLOGIC, Inc.

- Hanwha Vision America

- IDIS

Expert commentary

Security beat

The Key To Unlocking K12 School Safety Grants

DownloadHoneywell GARD USB Threat Report 2024

DownloadPhysical Access Control

DownloadThe 2024 State Of Physical Access Trend Report

DownloadThe Security Challenges Of Data Centers

DownloadKentixONE – IoT Access And Monitoring For Data Centers

Climax Technology HSGW-Gen3 Modular Smart Security Gateway

Delta Scientific DSC50 ‘S’ Barrier: Portable, Crash-Rated Vehicle Mitigation Solution