Touchless Biometric Systems (TBS) Access Control Accessories (2)

Browse Access Control Accessories

- Other Touchless Biometric Systems (TBS) products

- Touchless Biometric Systems (TBS) Access control readers

- Touchless Biometric Systems (TBS) Access control software

- Touchless Biometric Systems (TBS) Intruder detectors

- Touchless Biometric Systems (TBS) Access control controllers

- Touchless Biometric Systems (TBS) Access control systems & kits

Access control accessory products updated recently

Access control accessories - Expert commentary

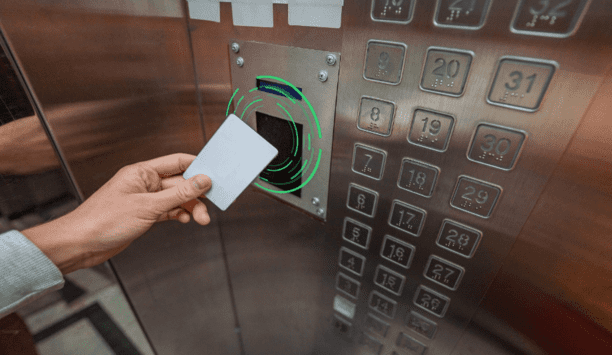

RFID and emerging mobile access technologies are easy to implement and allow elevator access to be integrated with other access control solutions throughout the building, from buil...

While the foundation of autonomous retail has been built up over the past few years, it is only now that retailers are beginning to fully experiment with the technology. There were...

From analog to digital, from stand-alone to interlinked, building systems are in a state of transition. Moreover, the rate of change shows no sign of slowing, which can make it dif...

Latest Touchless Biometric Systems (TBS) news

Touchless Biometric Systems, a Swiss provider of biometric technologies headquartered in Pfäffikon, Zurich, has unveiled its latest innovation in biometric management: the Bio...

Touchless Biometric Systems AG (TBS) presents the newest addition to its comprehensive portfolio of biometric readers and solutions: the 3D FLY. The innovative sensor performs trul...

The coronavirus pandemic had a monumental impact on all aspects of the business world, including the security industry. However, amid the gloom and doom, many security professional...

Related white papers

Three Essential Reasons To Upgrade Your Access Control Technology In 2022

10 Top Insights In Access, Cloud And More

Protecting Dormitory Residents and Assets

Trending topic articles

VITEC, a pioneer in IPTV and digital signage solutions, and Actelis Networks, Inc., a market pioneer in cyber-hardened, rapid deployment networking solutions for IoT applications, now announced a new...

WatchGuard® Technologies now announced the WatchGuard Zero Trust Bundle – a streamlined solution that finally makes zero trust achievable for organizations of all sizes. For y...

Fortinet®, the global cybersecurity pioneer driving the convergence of networking and security, now announced an integrated solution featuring FortiGate VM, Fortinet’s virtual cloud firewall...

dormakaba has signed a binding agreement to acquire Avant-Garde Systems Inc. (“Avant-Garde”), one of the largest independent solution providers for entrance systems control products in the...

Skills for Security has partnered with C-TEC to strengthen the training opportunities for apprentice fire and security technicians through greater access to current technologies and direct engagement...

Opengear, a Digi International company and a pioneering provider of secure and Smart Out of Band™ management solutions, announced now that it has achieved SOC 2 Type 2 and ISO 27001 compliance....

At CES 2026 in Las Vegas, demonstrations of Flir’s next-generation iXX-Series app-enabled thermal cameras will outline how users can transform electrical and mechanical inspections acr...

Allied Universal has sold a majority stake in AMAG Technology to Shore Rock Partners, a critical infrastructure-focused growth investor. AMAG is a global pioneer in integrated high-security access con...

Squire Locks USA has appointed Channel Championz, founded by security industry veteran Jerry Burhans, to lead its expansion into the North American critical infrastructure market. Burhans, a seasoned...

Netwatch, a provider of AI-powered security services, announced now that it has signed a definitive agreement to be acquired by GI Partners. Netwatch is a pioneering global provider of intelligent se...

Alibaba now unveiled the latest evolution of its visual generation models, the Wan2.6 series. It enables creators to appear in AI-generated videos as themselves and in their own voices with flexible...

In recent years, the development and adoption of AI technology has accelerated at an unprecedented pace, impacting various industries. Of course, the spark of innovation provided by AI is already a fe...

Matrix Comsec, a pioneer in Security and Telecommunication solutions, was honored with the CII Industrial Innovation Award 2025, recognizing Matrix as one of the Top 50 Most Innovative Companies in In...

i-PRO Co., Ltd. (formerly Panasonic Security), a pioneer in professional security and public safety solutions, now shared its predictions for the security industry in 2026. The year ahead will contin...

ANSecurity, a pioneering specialist in network security and wireless solutions, has successfully delivered one of the UK education sector’s first campus-wide Wi-Fi 7 deployments at Sir William P...

The Key To Unlocking K12 School Safety Grants

DownloadHoneywell GARD USB Threat Report 2024

DownloadPhysical Access Control

DownloadThe 2024 State Of Physical Access Trend Report

DownloadThe Security Challenges Of Data Centers

Download- Brigham Young University Enhances Security Operations with Genetec Operations Center

- Protecting A Manufacturing Site With Incedo™ Access Control Solution

- MLA Installs Mul-T-Lock's New MTL800 Platform For Premium Protection

- Pimloc And Rhombus Partner To Protect People And The Right To Privacy In The US