Market dynamics are changing the U.S. residential security market, creating new business models that better appeal to the approximately 70% of households without a security system. Smart home adjacencies have helped revitalize the traditional security industry, and alternative approaches to systems and monitoring for the security industry are emerging, including a new batch of DIY systems.

Growth in the residential security market and its position as the channel for smart home solutions have attracted numerous new entrants. Telecoms, cable operators, and CE (consumer electronics) manufacturers are joining traditional security players as they compete to fulfill consumer demand for safety and security. Connected products also provide a layer of competition as consumers must decide whether having category devices such as doorbell video cameras, networked cameras, and other products suffice for their security.

Increasingly Competitive Landscape

Smart home services can provide additional revenue streams for the security industry

For instance, IP cameras are a highly popular smart home device rooted in security, and Parks Associates estimates 7.7 million standalone and all-in-one networked/IP cameras will be sold in the U.S. in 2018, with $889M in revenues. Product owners may feel their security needs are fulfilled with this single purchase, as such dealers and service providers are under increasing pressure to communicate their value proposition to consumers. Categorically, each type of player is facing competition uniquely—national, regional, and local dealers all have a different strategy for overcoming the increasingly competitive landscape.

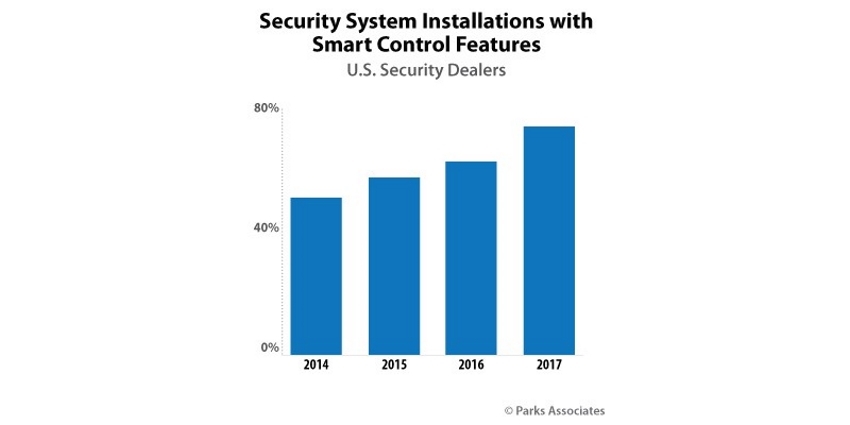

Smart home services can provide additional revenue streams for the security industry. In Parks Associates’ 2017 survey of U.S. security dealers, 58% report that smart home service capabilities enable extra monthly revenue. Almost half of dealers also note they have to offer smart home devices and services in order to keep up with their competition. While white-label devices are acceptable in some instances, dealers need to integrate with hero products whenever possible when those exist for a category.

|

| For dealers who have added smart home devices and services are all potential benefits and good for business |

Improved Customer Engagement

That 2017 survey also revealed 36% of security dealers that offer interactive services report security system sales with a networked camera and 16% report sales with a smart thermostat. For dealers who have added smart home devices and services, enhanced system utility, increased daily value, and improved customer engagement with the system are all potential benefits and good for business.

Security has served as the most productive channel for smart home solutions, mainly because the products create natural extensions of a security system’s functions and benefits, but as smart home devices, subsystems, and controllers expand their functionality, availability, and DIY capabilities, many standalone devices constitute competition to classical security. Particularly viable substitute devices include IP cameras, smart door locks, smart garage doors, or a combination of these devices. Products that are self-installed offer both convenience and cost savings, and these drivers are significant among DIY consumers—among the 6% of broadband households that installed a security system themselves, 39% did it to save money.

Enhance Traditional Security

Self-installable smart home devices may resonate with a segment of the market who want security

While many security dealers believe substitute offerings are a threat, some dealers do not find such devices an existential threat but instead view them as another path to consumer awareness. They argue that the difference between smart product substitutes and traditional security is that of a solution that provides knowledge versus a system that gives one the ability to act on that knowledge.

A common theme among professional monitoring providers is that a homeowner who is aware of events happening in the home does not necessarily have a secure and protected household. For example, a Nest camera, a DIY product, notifies a consumer via smartphone about events in the home when it detects motion, but only when the notification is opened and identified will a consumer be able to act on the related event. Self-installable smart home devices may resonate with a segment of the market who want security but are unwilling to adopt professional monitoring; however, providers can leverage these devices to enhance traditional security features and communicate the value of professional monitoring.

|

| Smart home devices and features, while posing a threat to some security companies, are a potential way forward to increased market growth |

Increased Market Growth

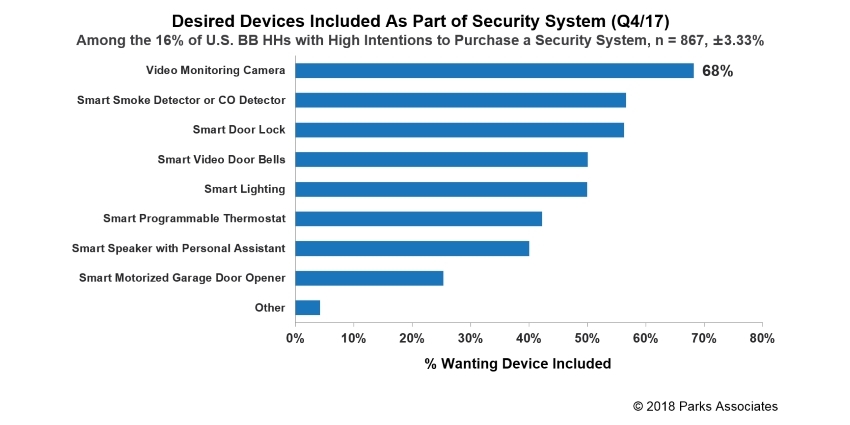

A key counterstrategy for security dealers and companies is to leverage their current, powerful role as the prime channel for smart home devices. Many security dealers now include smart home devices with their security systems to complement their offerings and increase system engagement. For example, as of Q4 2017, nearly 70% of U.S. broadband households that were very likely to purchase a security system in the next 12 months reported that they want a camera to be included as part of their security system purchase.

In response, many security system providers now offer IP cameras as optional enhancements for their systems. Smart home devices and features, while posing a threat to some security companies, are a potential way forward to increased market growth. Security dealers have an opportunity to become more than a security provider but a smart home solutions provider rooted in safety.

Provide Status Updates

Comcast has entered both the professionally monitored security market and the market for smart home services

The alternative is to position as a provider of basic security with low price as the key differentiator. Comcast has entered both the professionally monitored security market and the market for smart home services independent of security. It has discovered that monetizing smart home value propositions through recurring revenue becomes increasingly challenging as the value extends further away from life safety.

Since the security industry remains the main channel for smart home services, security dealers are in a unique position to leverage that strength. Value propositions must shift from the traditional arming and disarming of a system to peace-of-mind experiences that builds off the benefits of smart devices in the home to provide status updates (e.g., if the kids arrived home safely) and monitoring at will (e.g., checking home status at any time to see a pet or monitor a package delivery).

These types of clear value propositions and compelling use cases, which resonate with consumer and motivate them to expand beyond standalone products, will help expand the home security market.

Learn why leading casinos are upgrading to smarter, faster, and more compliant systems