Mobile cybersecurity pioneer, Trustonic, announced that it has joined the PCI Security Standards Council (PCI SSC) as a new Participating Organization. Trustonic will work with the PCI SSC to help secure payment data worldwide through the ongoing development and adoption of the PCI Security Standards.

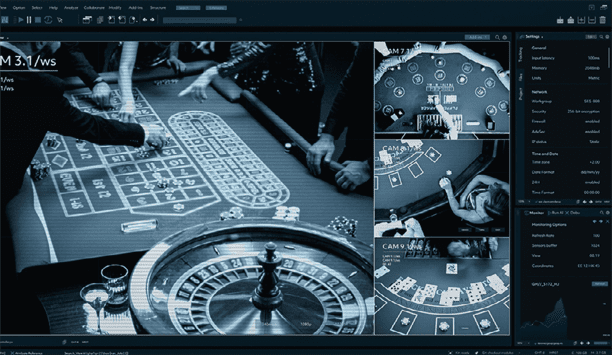

The PCI SSC leads a global, cross-industry effort to increase payment security by providing flexible, industry-driven and effective data security standards and programs. The keystone is the PCI Data Security Standard (PCI DSS), which provides an actionable framework for developing a robust payment card data security process and preventing, detecting and mitigating criminal attacks and breaches.

Improving payment security worldwide

As a Participating Organization, Trustonic adds its voice to the standards development process and will collaborate with a growing community of more than 800 Participating Organizations to improve payment security worldwide. Trustonic will also have the opportunity to recommend new initiatives for consideration to the PCI Security Standards Council and share cross-sector experiences and best practices at the annual PCI Community Meetings.

PCI Security Standards and resources help organizations secure payment data and prevent, detect and mitigate attacks"“In an era of increasingly sophisticated attacks on systems, PCI Security Standards and resources help organizations secure payment data and prevent, detect and mitigate attacks that can lead to costly data breaches,” said Mauro Lance, Chief Operating Officer of the PCI Security Standards Council. “By joining as a Participating Organization, Trustonic demonstrates they are playing an active part in improving payment security globally by helping drive awareness and adoption of PCI Security Standards.”

Protecting payment apps, data from hackers

“Standards are the foundations for cyber resilience and the delivery of simpler, richer and more secure payment services,” said Ben Cade, CEO of Trustonic. “Our technology has always been built on open standards, making it easier for financial services providers, developers and merchants to protect payment apps, data and IP from hackers and malware.

“Using smartphones as contactless mPOS terminals is one of the most exciting and disruptive trends in the payment technology space, but it presents new security challenges that can only be adequately resolved with a Trusted User Interface (TUI) secured by a hardware-based Trusted Execution Environment. As leaders in mobile app protection, we are perfectly placed to support our partner banks and fintechs with insight into challenges like this and how PCI standards are working to address them.”

Find out about secure physical access control systems through layered cybersecurity practices.