ISONAS, Inc. - Experts & Thought Leaders

Latest ISONAS, Inc. news & announcements

Squire Locks USA has appointed Channel Championz, founded by security industry veteran Jerry Burhans, to lead its expansion into the North American critical infrastructure market. Burhans, a seasoned industry executive with leadership roles at ISONAS, SimonsVoss, and ASSA ABLOY, brings over 30 years of experience in the U.S. security hardware and access control market. He will lead Squire’s North American expansion, with a focus on transportation, utilities, telecommunications, and other mission-critical infrastructure sectors. Squire’s Stronghold® series With 245 years of lock-making experience in the United Kingdom, Squire is recognized for its hard-wearing, industrial padlocks, including the world’s strongest production padlock, the S100CS. But beyond strength, Squire is also one of the few manufacturers whose padlocks undergo the rigorous EN12320 European testing standards for real-world attack resistance. These criteria are often more demanding and application-relevant than many U.S. benchmarks. “Squire’s Stronghold® series brings a level of mechanical security this market hasn’t seen in years,” said Burhans. “These aren’t just strong padlocks, they’re engineered and tested to survive in the real world. We’re talking about products that can resist drilling, cutting, sawing, freezing and corrosion, certified to EN12320 Grade 6, which goes far beyond U.S. standards. In critical infrastructure, that level of protection matters.” Squire’s inigma smart access control system Channel Championz will focus on introducing the Stronghold line to the U.S. market, alongside Squire’s inigma smart access control system. inigma enables users to manage access to compatible padlocks via Bluetooth, using a secure smart key programmed through a dedicated mobile app. Designed specifically for critical infrastructure applications, inigma eliminates the need for managing multiple physical keys across remote or dispersed sites. Just as importantly, the system offers centralized control and detailed audit trails, supporting compliance with NERC-CIP standards that require strict logging and traceability of access to protected utility assets. Security hardware distributors “Squire is bringing something security hardware distributors haven’t seen in a long time,” added Burhans. “An independent, family-owned manufacturer that’s technically sophisticated, strategically focused and truly committed to its U.S. partners.” “Distributors today aren’t just looking for a product, they’re looking for a partner who answers the phone, provides knowledgeable support and builds long-term relationships. You’re not dealing with a revolving door of salespeople or a diluted corporate structure. You’re getting consistent expertise, direct access to decision-makers, and a brand that’s here to invest in the channel, not bypass it.” High-performance security solutions John Squire, Global CEO at Squire, added: “We’re thrilled to be working with the Channel Championz team and to leverage Jerry’s expertise in this sector. They understand the value of strong distributor relationships and staying close to the customer, which aligns perfectly with Squire’s approach of building a long-term presence rooted in trust, service and performance." "Squire Locks USA is deeply committed to serving the North American market. This expansion underscores the company’s long-term dedication to providing North American critical infrastructure customers with trusted, high-performance security solutions to safeguard the systems that millions rely on every day.”

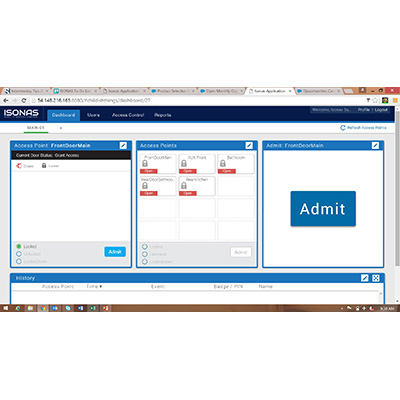

ISONAS Inc., a globally renowned IP access control and hardware solution provider, and part of the Allegion family of brands, has announced that the ISONAS Pure IP access control solution has been deployed at a school district in the southwest suburb of Chicago. With six buildings within the district, they wanted to be able to manage access at all buildings on one unified platform. Remote access The school district had three main priorities for the upgrade, which included controlling the flow of traffic during after-hour events, eliminating the need for keys to manually lock and unlock doors, and finally have the ability to utilize remote access. Safety was a huge priority at the school district, which included keeping students and staff safe and secure in all six buildings. Without being able to control unauthorized visitors at all entrance ways, there was no way to effectively protect everyone district-wide. ISONAS Pure IP access control solution Upon a strong recommendation from the school IT Director, ISONAS was awarded the project after the school put the project out for bid. The school district believed in the power of the ISONAS Pure IP solution and knew it was the right cloud-based technology to overcome all their current challenges. With the recommendation from the IT Director and a strong relationship with Advanced Wiring Solutions, the school district was ready to move forward with the security upgrade at high speed. Advanced Wiring Solutions is a Chicago-based premier low-voltage electrical contractor, who has handled structured cabling, security, access control, AV, and CCTV camera installations for over 20 years. ISONAS RC-04 reader controllers installed It’s been a pleasure working with ISONAS from the onset of this project to completion" The project was on a tight timeframe and included installing 188 ISONAS RC-04 reader controllers, in under three months, on every access point within the six buildings that made up the school district. “It’s been a pleasure working with ISONAS from the onset of this project to completion,” stated Michael Sanfratello, President at Advanced Wiring Solutions. Michael adds, “From when we were in the bidding stage to deploying the access control system, ISONAS worked closely with the architects, engineers and the school district to develop specifications for the design and installation in order to make it a perfect deployment.” Remote monitoring of controlled doors “We are extremely happy that the school district selected the ISONAS solution to successfully secure each entrance way and no longer had to rely on keys for access, making it a safer environment for everyone,” said Jonathan Mooney, ISONAS Sales Leader. The school district can now easily monitor all controlled doors remotely and set access schedules for regular school hours and after hours when special events and activities were taking place. With cloud-based access control systems in place, schools across the country can get a clearer picture of who is actually entering their grounds day and night, while not having to physically be on the premises.

ISONAS Inc., an IP access control and hardware solution provider and part of the Allegion family of brands announced that the ISONAS™ Pure IP™ access control solution has been deployed at Our Lady of Perpetual Help Parish in Grove City, Ohio. The parish is comprised of seven buildings, which include the church, preschool, elementary school, rectory, storage garage, athletic building, and modular classrooms. The parish grew from around a dozen visitors daily to more than 80 people visiting the church every weekday morning and more than 500 people visiting over three separate services each weekend recently. Controlling Access The elementary school has grown to host more than 300 students and 50 staff members and volunteers, with the preschool adding another 40 students and staff members to the campus tally. With 28 exterior doors encompassing the fully renovated church, school, and preschool, the parish needed a substantial security upgrade. The new system needed to not just limit access, but also control it. A main challenge at the parish was being able to control access at all seven buildings and provide an environment with improved personal security for their staff, students, and patrons. The security system the parish had in place consisted of a few standalone keypads and electric locks on a couple of doors with no centralized management or communication. Upgrading Security With an influx of people accessing the parish and its facilities, both the facilities director and the maintenance/technology specialist at the parish were ready to find the right access control solution. The new system needed to not just limit access, but also control it. After careful consideration and research, the parish selected the ISONAS™ Pure IP access control solution for their security upgrade. ISONAS introduced the parish to its local certified independent security integrators, Systems 28. “Working with ISONAS on this project was a tremendous experience from start to finish, and we were thrilled to be brought on board to handle this security upgrade,” said Scott Hoover, sales estimator at Systems 28. “As a certified independent ISONAS systems integrator, we were proud to install this unique solution at our local parish and help make our community safer.” ISONAS RC-04 reader controller The parish also liked the fact that an on-site server was not required with the ISONAS solution The project consisted of installing 24 ISONAS RC-04 reader controllers, with 21 deployed on exterior doors and three on interior doors in a month’s timeframe. The parish chose the ISONAS solution for a myriad of reasons, with one main factor being the ability to use power over the ethernet for the card readers and electric locks. The parish also liked the fact that an on-site server was not required with the ISONAS solution, as having a cloud-based server was critical to managing access remotely for multiple buildings. ISONAS Pure Access software “We are extremely happy that the parish selected ISONAS as the right solution for their security upgrade and look forward to providing capabilities to easily expand the system in the future,” said Jonathan Mooney, ISONAS sales leader. The ISONAS system is extremely user-friendly and much more convenient Along with the ISONAS hardware, the ISONAS Pure Access software was deployed for its remote access capabilities. Pure Access™, ISONAS’s software, is a cloud-based access control application that provides users the ability to manage their access control from anywhere at any time, on any device. Remote access functionality “The ISONAS system is extremely user-friendly and much more convenient than the previous ‘stand-alone’ system we had in place prior to this upgrade,” said Kevin Radwanski, facilities director at Our Lady of Perpetual Help Parish. “We especially like the remote access functionality, as it has been great for us to be able to lock and unlock doors remotely during regular times and emergency situations like the global pandemic.”

Insights & Opinions from thought leaders at ISONAS, Inc.

Cybersecurity has become a major element – and a major source of discussion – in the physical security marketplace as a result of the rise in networked systems. And we may still not be talking enough about cybersecurity. Here is part one of our Cybersecurity series. “Cybersecurity requires everyone in the security industry to be playing offense and defense at the same time, every single day,” says Bill Bozeman, President and CEO of PSA Security Network. “It needs to just become part of the standard conversation when we are talking about physical security because they are so intertwined.” Creating New Industry Leaders Cybersecurity and physical security can be seen as two parts of a single entity, and increasingly the two will be combined at the enterprise level over the next several years. “This convergence of physical security and cybersecurity will create new industry leaders that will emerge to lead a new segment of the combined market through strong investment and leadership,” says Rob Lydic of ISONAS, now part of Allegion. Data capture form to appear here! Cybersecurity issues dominate almost every discussion in today’s physical security industry, and the clear message is that “manufacturers and integrators must continue to create robust and scalable cybersecurity offerings to protect customer data and facilities,” says Lydic. He contends that cloud services providers (such as ISONAS) are more cybersecure and reliable ‘by orders of magnitude’ than non-cloud solutions. Cybersecurity is linked to cloud-based systems and managed security service provider models Cloud-Based Services The Security Industry Association (SIA) has listed cybersecurity as one of 2019’s ‘Top Megatrends’ in the physical security market. SIA says it is important to prioritize cybersecurity among security businesses, for customers’ businesses, and for vendors. The trend calls for continual process improvement and investment. Bill Bozeman of PSA Security Network agrees: “Cybersecurity has definitely taken a strong foothold in the industry.” With the continued expansion of cloud-based services, cybersecurity will be more important than ever to integrators, manufacturers and end users alike, he says. Notably, cybersecurity is directly linked to two other important industry trends listed by Bozeman: cloud-based systems and the rise in recurring monthly revenue (RMR) and managed security service provider (MSSP) models, whose focus will include cybersecurity. Loss Prevention Executives The days when cybersecurity was exclusively the domain of the information technology (IT) department are gone. “Cybercrime is one of the biggest threats organizations of all sizes and types face today,” says Michael Malone, CEO of ADT Cybersecurity (formerly known as Datashield). “Considering the magnitude of these crimes, it now falls on the entire organization, including the traditional security or loss prevention executives, to band together to combat these threats.” Cybercrime is one of the biggest threats organizations of all sizes and types face today Malone favors (and his company offers) a managed detection and response (MDR) service, which combines advanced technology and human analysis. Using packet capture on the network, an MDR analyst can ‘replay’ a cyber security event and dig deeper into the incident and determine remediation steps. It’s an approach that significantly cuts through false positive ‘noise’ so security teams can focus on what matters. Helping Security Officers Interestingly, cybersecurity is poised to benefit from another major trend in the physical security market – the rise of artificial intelligence. Specifically, machine learning applications for cybersecurity include: detecting malicious activity, helping security officers determine what tasks they need to complete in an investigation process, analyzing mobile endpoints, decreasing the number of false positive threats, automating repetitive tasks like interrupting ransomware, and potentially closing some zero-day vulnerabilities. But AI in this case is not a panacea. Christopher McDaniels of Mosaic451 recommends pairing human intellect with machine technology to sort through data faster and catch hackers before they do much damage. See part two of our Cybersecurity series here.

Consolidation persisted in the physical security industry in 2018, and big companies such as Motorola, Canon and UTC continued to make moves. Also among the mergers and acquisitions (M&A) news in 2018 was a high-profile bankruptcy (that ended well), continuing consolidation in the integrator market, and the creation of a new entity called “LenelS2.” Here’s a look at the Top 10 M&A stories in 2018: 1. Motorola Acquires Avigilon Motorola Solutions announced in February that it had entered into a definitive agreement to acquire video surveillance provider Avigilon in an all-cash transaction that enhances Motorola Solutions’ portfolio of mission-critical communications technologies. Avigilon products are used by a range of commercial and government customers including critical infrastructure, airports, government facilities, public venues, healthcare centers and retail. The company holds more than 750 U.S. and international patents. 2. UTC Climate, Control & Security Buys S2 Security UTC Climate, Controls & Security agreed in September to acquire S2 Security, a developer of unified security and video management solutions. UTC subsequently combined S2 with its Lenel brand to create LenelS2, “a global leader in advanced access control systems and services” with “complementary strengths.” 3. Costar Technologies Acquires Arecont Vision After Bankruptcy Arecont Vision, the provider of IP-based megapixel camera and video surveillance solutions, announced in July that the acquisition by Costar Technologies, Inc. of its assets had been approved by the bankruptcy court. After the closing of the sale, the company began operating as Arecont Vision Costar, LLC and is part of Costar, a U.S. corporation that designs, develops, manufactures, and distributes a range of products for the video surveillance and machine vision markets. 4. Allegion Acquires Access Control Company ISONAS Allegion plc, a security products and solutions provider, agreed in June to acquire ISONAS through one of its subsidiaries. ISONAS’ edge-computing technology provides access control solutions for non-residential markets. ISONAS' devices – like its integrated reader-controllers – utilize power over ethernet, making them easy to install and cost effective as they utilize existing customer infrastructures. The company is based in Boulder, Colo. 5. HID Buys Crossmatch for Biometrics HID Global announced that it had acquired Crossmatch, a provider of biometric identity management and secure authentication solutions, from Francisco Partners. Crossmatch’s portfolio of products includes biometric identity management hardware and software that complement HID’s broad portfolio of trusted identity products and services. 6. BriefCam Announces Acquisition by Canon BriefCam, a global provider of video synopsis and deep learning solutions, announced its acquisition in May by Canon Inc., a global digital imaging solutions company. The addition of BriefCam to Canon’s network video solutions products portfolio complements the Canon Group’s previous acquisitions of Axis Communications and Milestone Systems. 7. Allied Universal Acquires U.S. Security Associates Allied Universal, a security and facility services company, finalized its acquisition of U.S. Security Associates (USSA) in October, further building on its position in the security services industry. This acquisition includes Andrews International (including its Government Services Division and Consulting and Investigations and International Division) and Staff Pro. 8. Johnson Controls Acquires Smartvue Corp. Johnson Controls announced in April that it had acquired Smartvue, a global IoT and video provider that empowers cloud video surveillance and IoT video services. The addition of the Smartvue cloud-based video platform will enhance Johnson Controls’ offering of an end-to-end, smart cloud-based solution that can provide superior business data and intelligence to customers and added value to partners. 9. ADT Acquires Red Hawk Fire & Security (and Others) ADT Inc.’s acquisition of Red Hawk Fire & Security, Boca Raton, Fla., was the latest move in ADT Commercial’s strategy to buy up security integrator firms around the country and grow their footprint. In addition to the Red Hawk acquisition, announced in mid-October, ADT has acquired more than a half-dozen security system integration firms in the last year or so. 10. Convergint Technologies Continues to Acquire Convergint Technologies announced in August the acquisition of New Jersey-based Access Control Technologies (ACT), bringing further electronic security systems experience to Convergint's service capabilities. Convergint has strategically grown its service footprint across the United States, Canada, Europe and Asia Pacific through strong organic growth and the completion of 18 acquisitions since early 2016. And it continues: Convergint announced acquisition of SI Technologies, Albany, N.Y., in November and Firstline Security Integration (FSI), Anaheim, Calif., in December. (And Convergint itself was acquired in February by private equity group Ares Management.)

One of the biggest recent security divestitures in the news was the sale of Mercury Security to HID Global, which occurred around a year ago. The seller in that transaction was ACRE (Access Control Related Enterprises), also the parent company of Vanderbilt and ComNet. We recently spoke to founder and CEO Joe Grillo, a 30-year industry veteran, about the mergers and acquisitions (M&A) market, ACRE’s future, and new opportunities opened up by the Mercury sale. Q: What’s new with ACRE? Grillo: We have an opportunity to have organic growth and to have some scale on a global basis to be a decent size player" ACRE is a company I founded in 2012, and since then we have had six acquisitions and one divestiture. We’ll never focus on ACRE as a brand, but we currently have more visibility of ACRE as a parent company with our two strong brands, ComNet and Vanderbilt. Last year was a very busy year [with the sale of Mercury Security to HID Global] because it takes as long to sell a brand as to buy one, maybe more so. Q: What’s next? Grillo: What you are seeing from us this year is that we are again in a buying mode. No announcement yet, but we expect one by the end of the year. We are well-funded, have great partners, and see an opportunity to continue to grow acquisitively as our highly fragmented space of access control continues to consolidate. From the standpoint of ACRE, with the ComNet and Vanderbilt brands, we are also doing more integration on the backside – not what the customer sees. We will continue to grow toward a $200 million business. We were there when we owned Mercury, and we will get there again. We have an opportunity to have organic growth and to have some scale on a global basis to be a decent size player. Because ACRE are owned by a private equity company, we are brought into every opportunity: ComNet is a good example" Q: Do you see the M&A market being more competitive – more companies looking to acquire? Grillo: There’s a lot of money chasing not-so-many deals, so evaluations can get expanded. But as interest rates creep up, it is definitely a challenge to find the right valuation, the right financing and the right strategic fit. It is a very strategic market. Q: There have been some big acquisitions lately. Were you guys involved at all in evaluating those opportunities? Grillo: Because we are owned by a private equity company, we are brought into every opportunity. An example of that was ComNet. I would not have been aware that the founder passed away two years ago and that there was this opportunity to own the business. So we look at everything; anything that’s out there we look at. The biggest recent announcement in our world was S2 (being sold to UTC/Lenel), and, yeah, we looked at that. It didn’t fit our profile – it was too expensive. Great business, and it’ll be interesting to see how it fits into the UTC environment. There was also Isonas [which was recently sold to Allegion], but the size didn’t add enough scale, but I like the technology. ComNet sells communication networking solutions and products, which is more attractive than video systems for ACRE Q: So what are you looking for in an acquisition? Grillo: It’s hard for us to find something that moves the needle, and you have to find that right balance. Is it something we can digest and have the financing for, and also is there room on the back end? We are private equity-owned, so we know there will be an exit for our investors, too. So we have to find the right balance, good valuations, the right size and digestible. If you look at our acquisitions, we have done two “carve outs.” The Vanderbilt name didn’t exist until we bought the business from Ingersoll Rand, and then we bought the [intruder] business from Siemens. That’s how Vanderbilt came about. You get a lot of value when you carve out a business, but there’s a lot of work. In the case of Mercury or Access Control Technology (ACT) that we acquired; they were growing and profitable but they stretch your finances a lot more. So you have to find the right mix in there. Q: Does video interest ACRE at all? Grillo: We have to find the right balance, good valuations, the right size and digestible"ComNet is our video play. ComNet sells communication networking solutions and products, and 70 to 80 percent of that is used for video systems. But unlike cameras, which don’t interest us, it’s actually good margins, highly specialized repeat business and with good channel partners. So where are we going to play? Cameras – no (because of commoditization). We have some recorder technology (from the Siemens acquisition) and we have the communication networking technology (with ComNet). On the software side, we have looked at a lot of the VMS companies, and a lot of them have been on the market. But the valuation expectations can be high because they are software companies. And we really believe in partnering as a good thing, too. If we integrate to Milestone or Salient or some of these companies, we will never lose an access control client because they chose a particular VMS. Q: ACRE is also looking to grow organically, isn’t it? Grillo: From a technology perspective, we are a product company and we are continuing to bring new products to the market with the ComNet communication networking business and the access control business. And in Europe, we have a third leg of the stool, which is the very successful intrusion and burgular alarm business we acquired from Siemens (SPC products now sold under the Vanderbilt brand). That business continues to do well and is now one of the highest performing segments in our portfolio.The intrusion and burgular alarm continues to do well and is now one of the highest performing segments in our portfolio" Q: But you don’t have to own a company to make it part of your solution. Grillo: An important word is integration. We have to integrate to all the wireless locks. We have to integrate to the VMS systems. But we don’t have to own them. Q: How has the Mercury Security divestiture impacted the rest of your business? Grillo: It has opened up the opportunity for us to look at Mercury partners as possible acquisition targets without worrying about conflicts with the very good business of Mercury. We have more flexibility now compared to the Mercury era. Q: How will the economic cycle impact the security market? Grillo: Interest rates are a much bigger issue than the overall economic cycle. We talk a lot about it with our owners – clearly interest rates are tightening up. If you go out to do acquisitions or to borrow money to do something with your business, it will be tougher than it was two years ago, and it may get worse in the next two years. Security is less impacted by the economic cycle than some industries.

The Key To Unlocking K12 School Safety Grants

DownloadHoneywell GARD USB Threat Report 2024

DownloadPhysical Access Control

DownloadThe 2024 State Of Physical Access Trend Report

DownloadThe Security Challenges Of Data Centers

DownloadISONAS' New Software Development Kit Offers Customers The Power Of Choice In Access Control Hardware

ISONAS Takes IP Access Control To The Cloud And Gives Integrators An Off-The-Shelf Managed Access Control Platform

ISONAS RC-04-PRX-WK Wallmount Keypad Reader-Controller