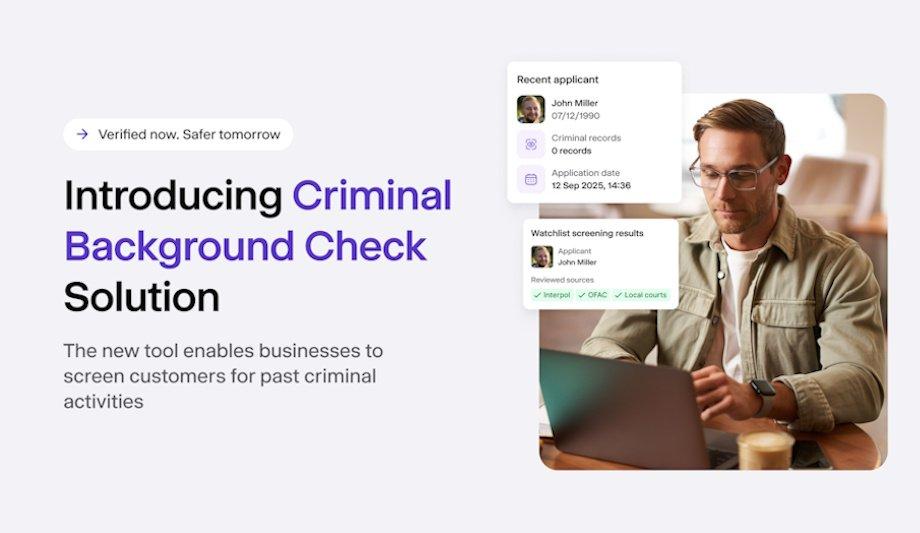

iDenfy has introduced its new Criminal Background Check tool, empowering businesses to automatically screen various government databases to gather information on individuals and identify potential criminal connections.

This enhancement is part of iDenfy's efforts to streamline access to official databases across all U.S. states, bolstering risk assessment strategies for entities that require detailed reviews before onboarding clients or partners.

Streamlined risk Assessment for U.S. Entities

Reports indicate that financial crimes cost consumers over $12.5 billion in 2024—a rise of approximately 25% compared to the previous year.

In response, iDenfy’s Criminal Background Check proves invaluable for scrutinizing corporate clients, vendors, and partners, facilitating the screening of directors, shareholders, and key personnel against global criminal and sanction lists. This capability allows organizations to assess compliance risks associated with new clients or partners prior to making sizable business commitments.

AI-Powered Data Matching and Reporting

These data points are synthesized into a single PDF report, detailing vital personal and corporate identity information

The Criminal Background Check tool not only checks standard screening results but also sifts through government databases to present detailed criminal histories—covering offense types, severity, court details, and timelines. This comprehensive, audit-ready overview supports compliance teams in making timely and informed decisions.

Through advanced AI-powered data matching, even incomplete or inconsistent records are likely to be accurately flagged, reducing the risk of oversight. These data points are synthesized into a single PDF report, detailing essential personal and corporate identity information.

Comprehensive Identity and Offense Tracking

The reports generated by the tool include verified identity data, offense categories, case updates, arrest records, outstanding warrants, court proceedings, inmate records, sex offender listings, and any negative media coverage.

Domantas Ciulde, CEO of iDenfy, highlighted the advantages, stating, "By integrating all systems into our RegTech platform, we eliminate manual queries across multiple sources, providing analysts with comprehensive records in real-time."

Reducing Fraud Exposure in Regulated Industries

The Criminal Background Check assists in rapidly spotting red flags, holding audit-ready records

This tool is beneficial to industries subjected to heavy regulation, such as banking and fintech. It aids in managing large customer volumes and detecting risks earlier to mitigate fraud exposure.

The Criminal Background Check assists in rapidly spotting red flags, maintaining audit-ready records, tracing court proceedings, and verifying individuals’ compliance potentials across various jurisdictions.

Real-Time Data for AML Screening

Additionally, iDenfy offers real-time access to global enforcement watchlists and sanction databases—such as Europol, FBI, NCA, Interpol, and others—enhancing its Anti-Money Laundering (AML) screening capabilities. This feature aids organizations in identifying entities potentially associated with unethical activities, thus safeguarding against financial, reputational, and regulatory risks.

"With global regulators tightening AML standards, businesses require tools with precision and scalability," added Domantas Ciulde. "Our Criminal Background Check feature not only ensures compliance but also preserves brand reputation and builds enduring client relationships."

Discover how AI, biometrics, and analytics are transforming casino security

iDenfy, a pioneering identity verification and fraud prevention software provider, announced the launch of its Criminal Background Check feature, allowing businesses to automatically screen different government databases, extract information about an individual, and help find out if they have links to crime.

This helps streamline access to official government databases from all U.S. states and improve risk assessment practices, especially for U.S.-based entities and their clients that need to be thoroughly reviewed before onboarding or throughout the whole business relationship.

iDenfy’s criminal background

In 2024, consumers reported losing more than $12.5 billion to financial crimes, which reflects an approximately 25 percent increase over the previous year. iDenfy’s criminal background check function is especially valuable to onboard corporate clients, vendors, and partners, as it allows for screening a company’s directors, shareholders, and key personnel against global criminal and sanction databases.

This capability helps organizations determine whether a potential client or partner poses a compliance risk before engaging in high-value transactions or business relationships.

Advanced AI-powered data matching

The latest Criminal Background Check feature goes beyond standard screening results. It automatically scans and looks through official government databases to find any criminal records. It shows details like the type of offense, how serious it was, the court case information, sentencing date, and release date.

In this way, by providing a comprehensive and audit-ready overview, iDenfy can help compliance teams to make informed decisions quickly and effectively.

The tool also incorporates advanced AI-powered data matching to ensure that even incomplete or inconsistent criminal records are accurately flagged, to minimize the risk of missing critical information. All data can be compiled in a single PDF report with a full breakdown of the individual who is being screened.

Personal and corporate identity data

The report includes verified personal and corporate identity data, offense classifications, case statuses, arrest records, warrants, court documents, inmate information, sex offender registries, and adverse media coverage.

According to Domantas Ciulde, the CEO of iDenfy, the new feature saves time and the hassle for compliance officers because it enables centralized access to all U.S. federal and state criminal databases:

“By connecting all systems and searches into our RegTech platform, we eliminate the need for manual queries across multiple sources and provide analysts with comprehensive records in real-time,” explained Domantas Ciulde.

New Criminal Background Check

The report includes verified personal and corporate identity data, offense classifications, case statuses, arrest records, warrants, court documents, inmate information, sex offender registries, and adverse media coverage.

This functionality supports all regulated industries, such as banking and fintech, helping large-scale entities in managing high customer volumes, detecting potential risks earlier, and reducing exposure to fraud.

The new Criminal Background Check helps organizations detect red flags much faster, not to mention the ability to maintain audit-ready documentation instantly, check whether the individual has had any criminal offenses, including details like court cases, offense class, and release dates, and gain full confidence knowing if the users could meet stringent compliance obligations across multiple jurisdictions.

Real-time data access

For effective Anti-Money Laundering (AML) screening and for those that want to automate various compliance tasks, iDenfy also offers real-time data access from the main global law enforcement watchlists and international sanction databases, including Europol, FBI, NCA, Interpol, World Bank, SECO, and many more worldwide.

This enables organizations to identify individuals or entities potentially linked to illegal or unethical activities and provide an added layer of protection against financial, reputational, and regulatory risks.

Domantas Ciulde, CEO of iDenfy, added: “With regulators worldwide tightening AML requirements, businesses need tools that could provide both accuracy and scalability. Our Criminal Background Check feature helps clients not only meet compliance demands but also protect their reputation and long-term customer relationships.”